-

Get the latest news! Subscribe to the ifa bulletin

The royal commission will this week hear no case studies involving the sale of life insurance through financial advisers, who received over $6 billion in life insurance commissions over a five-year period.

The third day of the sixth round of Hayne’s hearings is underway, where the commission will continue to hear from Freedom Insurance chief operating officer Craig Orton and new witness Helen Troup of CommInsure.

Yesterday, the commission heard from Grant Stewart, a Baptist minister and the father of an adult son with Down syndrome on a disability support pension. Mr Stewart told the inquiry that in June 2016, his son, who was 26 at the time, was sold policies by Freedom Insurance.

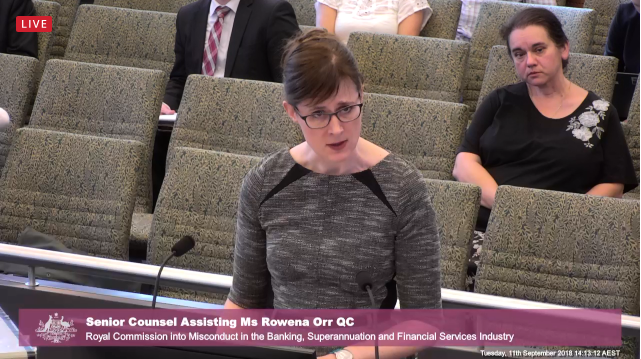

But financial advisers won’t be in the spotlight this week, according to counsel assisting Rowena Orr QC.

In her opening statement on Monday, Ms Orr reminded Commissioner Hayne that the financial advice industry was the subject of the second round of the commission’s hearings, which took place in April.

“Because issues relating to financial advice were considered in some detail in those hearings, the sale of life insurance through financial advisers will not be the subject of a specific case study in the coming week,” she said.

“However, in recognition of the significant role that financial advice plays in the sale of life insurance, we want to say something further about what the witness statements from the 10 life insurers say about the sale of life insurance through this channel.”

The royal commission asked the 10 life insurers to provide information about the monetary and non-monetary benefits that they, as product issuers, provide to financial advisers.

One of the topics addressed in the second round of hearings was the way in which particular remuneration structures for financial advisers could lead to poor financial advice. Another topic addressed in that round of hearings was the ban on conflicted remuneration that was introduced in July 2013 as part of the Future of Financial Advice reforms, and the various exceptions to that ban.

The commission heard that life insurers paid over $6 billion in commission to financial advisers over a five-year period.

“In the five-year period that we asked about, Zurich paid more than $113 million in commissions in respect of its life insurance products,” Ms Orr said.

“AMP paid more than $380 million. MetLife paid more than $390 million, CMLA paid more than $460 million, Suncorp paid more than $590 million, Westpac paid more than $640 million and a further $112 million in grandfathered commissions in relation to life insurance arrangements within superannuation accounts. AIA paid more than $690 million.

“OnePath paid more than $830 million. TAL paid more than $840 million. And MLC paid more than $1.16 billion in commissions.

“That amounts to a total of more than $6 billion in commissions to financial advisers in connection with the sale of life cover issued by these 10 insurers in about five years.”

The commission heard that in 2017, more than half of the premiums paid in relation to new policies issued by these life insurers came from policies sold through financial advisers.

Never miss the stories that impact the industry.