-

Get the latest news! Subscribe to the ifa bulletin

Property investors are losing out on outdoor depreciable assets.

Property investors are losing out on outdoor depreciable assets.Many property investors are unaware of the significant tax deductions that could be lying just outside their front door.

Outdoor assets such as garden sheds and patios are often overlooked when claiming depreciation benefits, but can yield thousands of dollars in additional deductions.

Property depreciation on outdoor assets can be a useful tool to facilitate an increase in the rental yield or capital gain of investment properties. By installing additional structures and fittings exterior to an investment property, property investors can increase the value of the property for potential tenants and purchasers, then claim property depreciation deductions on the assets to partially offset the cost of the items.

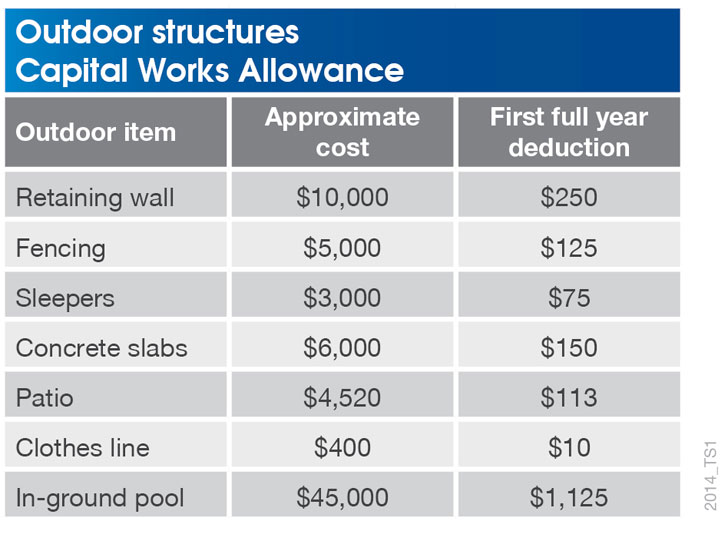

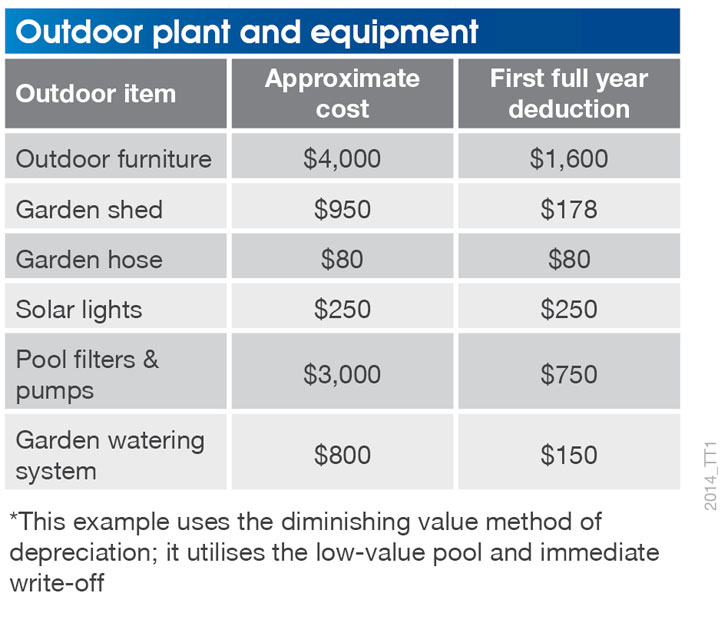

Outdoor assets can be claimed as capital works or plant and equipment items. Capital works refer to the historical cost of a structure and any non-removable assets, whereas plant and equipment items include any removable or mechanical fixtures and fittings. Depending on an asset's category, different depreciable rates can be claimed based on their effective life.

Examples of outdoor structures which qualify for the Capital Works Allowance include:

Examples of outdoor plant and equipment items that property investors may be able to claim for include:

Outdoor assets such as those listed above can make a substantial difference to a property investor's cash flow. When advising a client on a property with existing or potential for outdoor structures and fittings, be sure to inform them of the depreciation benefits that may be available. It is essential for property investors to understand the depreciation implications of both the inside and outside of their current and prospective properties in order to make informed decisions. Educating them on the depreciation benefits that could be available is a great way to ensure that they are not overlooking valuable deductions that would otherwise be sitting in the bottom of their investment property's garden.

Never miss the stories that impact the industry.