A word from State Street Global Advisors

At State Street Global Advisors, we have created some of the world’s most innovative and groundbreaking exchange traded funds (ETFs). And always with good reason:

Thirty years ago, we built the first US-listed ETF — the SPDR S&P 500 ETF (SPY) — to give the markets a better way to invest.

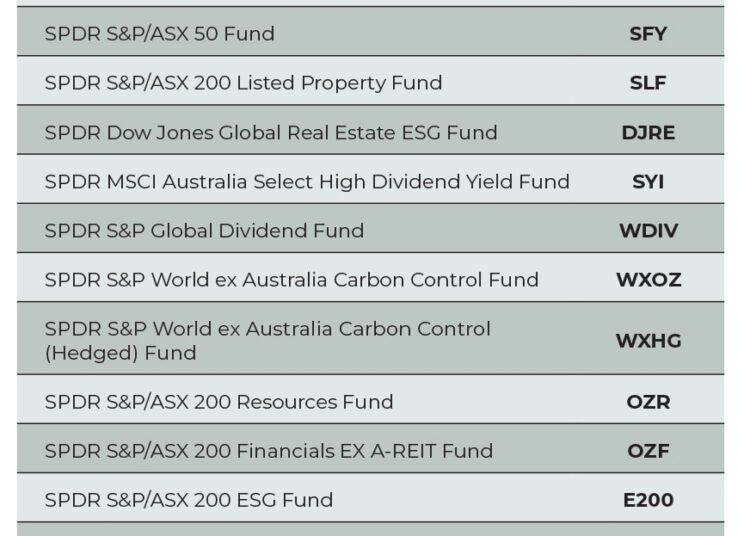

We designed Australia’s first ETFs, the SPDR S&P/ASX 200 Fund (STW) and the SPDR S&P/ASX 50 Fund (SFY), to provide investors with inexpensive and easy access to instant diversification.

With a history in ETF innovation and four decades of investment management experience on our side, we have created ETF solutions to help you invest across a variety of asset classes, geographies, capitalisation ranges, and styles at low cost.

So, whether you are looking to build a low-cost portfolio for your clients, or for a better trading strategy, we focus our skill on helping millions of people achieve their financial goals.

The stock market crash of 1987 remains one of the most significant events in financial history. In just one day — on what is now known as Black Monday — US markets plummeted by more than 20 per cent, with shockwaves reverberating to every corner of the globe including Australia.

But it was in the aftermath of this event, and the call by US regulators for a trading vehicle that would provide an additional layer of liquidity for US stocks, that the SPDR S&P 500 ETF Trust (SPY) was created, explains Kathleen Gallagher, head of SPDR ETFs Australia at State Street Global Advisors.

“The SEC basically thought that, if there was some sort of investment vehicle that was on hand for market participants, there probably could be a better way in which they could manage volatility or navigate the markets when they’re under stress,” she says.

“State Street, given its custody and indexing business, got a tap on the shoulder, and six years later, SPY was born.”

On 29 January 1993, SPY was officially listed on the American Stock Exchange with a relatively modest US$6.5 million in assets under management.

“In SPY, the market had a tradeable, physically backed product that allowed institutional investors to equitize cash, traders to hedge risk and volatility,” Ms Gallagher says.

“And for your individual investors, it gave them the ability to invest in a broad market in just one trade. Basically, SPY offered liquidity and the ability to buy and sell during times of stress. That’s the whole reason SPY came about.”

Thirty years later, SPY now ranks as the largest, most liquid, and most heavily traded ETF in the world, with US$380 billion in assets under management and an average daily trading volume of US$39 billion.

Ms Gallagher suggests that since the launch of SPY back in 1993, the global ETF industry has gone from “strength to strength”.

“We now have an ETF industry that is around US$10 trillion in assets and with over 10,000 ETFs,” she notes.

“We have also seen similar exponential growth of the Australia ETF industry.”

State Street was also responsible for pioneering Australia’s first-ever ETF with the launch of the SPDR S&P/ASX 200 Fund (STW) and the SPDR S&P/ASX 50 Fund (SFY) in August 2021. Today, approximately 280 ETFs are available in Australia, with the local industry having surged to a staggering $139 billion in assets under management.

STW continues to rank as one of the largest and most popular ETFs for investors in Australia, with a market capitalisation of $4.8 billion.

But ETFs now span a wide range of product categories including domestic equities, international developed equities, emerging equities, fixed income, commodities, smart beta strategies, and especially in more recent times, environmental, social, and governance (ESG).

How advisers are using ETFs

According to Ms Gallagher, ETFs have significantly changed the way Australian financial advisers are able to invest by providing advisers with efficient and cost-effective access to numerous asset classes and investment strategies.

Ms Gallagher highlights that financial advisers are increasingly embracing ETFs as fundamental “building blocks” for implementing asset allocation decisions for their clients.

“They can use them strategically as a core exposure or they can use them tactically when they see an opportunity in the market where they can add further returns for their clients, so many of the sub-asset classes or sector ETFs give them the ability to do that,” she explains.

During the more risk-off environment that has been seen over the past two years, Ms Gallagher notes that State Street has observed a notable trend among advisers who are striving to generate more income for their clients, particularly when returns are not as substantial.

In particular, State Street has received significant interest in its dividend-focused ETFs, including the SPDR MSCI Australia Select High Dividend Yield Fund (SYI) and the SPDR S&P Global Dividend Fund (WDIV).

“There’s also smart beta ETFs that can come into play,” Ms Gallagher adds.

“We have a fund which looks at factors that leverage things like quality, value, in a way to manage volatility in the market as well. So, as advisers try to become a little bit more defensive in their clients’ portfolios, that’s another way they’re using ETFs.”

State Street’s range of smart beta ETFs includes the SPDR MSCI World Quality Mix Fund (QMIX), which tracks the returns of the MSCI World Factor Mix A-Series Index and seeks to represent the performance of quality, value, and low volatility factor strategies.

But Ms Gallagher points out that ETFs are also being used in the creation of model portfolios.

“Model portfolios give advisers the ability to outsource the investment component in order to improve the overall efficiency of their practice and thus, focus on client outcomes” she says.

As advisers are becoming used to using ETFs in their day-to-day business practices, Ms Gallagher argues that their confidence in them has grown.

“I think their popularity is evident in the flows that ETFs are attracting in the Australian market,” she continues.

“Year to date, even though we do have some challenges this year with rising interest rates, stubborn inflation and recession concerns, ETFs are still gathered around US$1.7 billion in flows in the Australian market.”

Black Monday

The stock market crash of 1987, known as Black Monday, occurred on 19 October 1987.

On this date, the Dow Jones Industrial Average fell by 22.6 per cent, which is the largest one-day percentage decline in the history of the index. The S&P 500 also recorded its largest ever one-day percentage decline, suffering a fall of 20.5 per cent.

In Australia, where the event is known as Black Tuesday due to time zone differences, the local stock market dropped by around 25 per cent.

Black Monday had significant impacts on the global financial system, causing major losses for investors and leading to a period of economic uncertainty.

In the aftermath, investigators at the US Securities and Exchange Commission (SEC) concluded that the creation of a market maker to trade a market basket of stocks would likely have limited the impact that program trading had on Black Monday.

The value of ETFs

Ms Gallagher notes that her move from constructing asset allocation mandates for larger pension funds to developing ETFs solutions for intermediaries in 2008, coincided with the Global Financial Crisis (GFC).

“I experienced first-hand ETFs yet again doing exactly what they were meant to do, providing investors with the flexibility to buy and sell into the market quickly, easily, and cost-efficiently.

“With each crisis since the GFC, whether it be the recent pandemic or war in Ukraine, ETF, as an investment vehicle, has held up and continue to gather flows.”

To mark the 30th anniversary of the launch of SPY, State Street Global Advisors conducted a global survey to gauge the attitudes of investors around the world towards ETFs.

Essentially, the findings of the survey reaffirmed the popularity of ETFs as a vehicle that can help investors remain confident in their investing capability.

The survey found that more than half of all investors said that ETFs offer more liquidity to respond rapidly to market changes and can mitigate risk better in volatile markets versus other types of investments.

“What we found is that basically, seven in 10 investors believe that the volatility in the markets is going to continue for the next 12 months, and six in 10 of those investors agree that when there is volatility in the market, it’s obviously important for them to have liquid investments, and it’s ETFs that they tend to turn to,” Ms Gallagher says.

ETFs now and into the future

One major trend in the ETF space identified by State Street Global Advisors is the move towards environmental, social, and governance investing (ESG).

On the back of an “ESG wave” seen in Europe, the Middle East, and Africa, the firm anticipates a continued focus on ESG in Australia alongside greater focus from local and global regulators.

“We’re seeing demand for ESG from all types of investors, institutions to self-managed super funds as well as to your mum and dad investors as well,” Ms Gallagher points out.

Last year, State Street Global Advisors “evolved” four of its SPDR ETFs to improve their ESG profiles without compromising the original investment objectives of each fund.

These include the SPDR Dow Jones Global Real Estate ESG Fund (DJRE), the SPDR S&P World ex Australia Carbon Control Fund (WXOZ), the SPDR S&P World ex Australia Carbon Control (Hedged) Fund (WXHG), and the SPDR S&P Emerging Markets Carbon Control Fund (WEMG).

With this change, State Street explains that the funds continue to deliver investment characteristics similar to their original benchmarks, which, it says, means that investors can access improved ESG criteria without compromising their portfolio’s original objectives.

Additionally, fixed income is also expected to be a major trend in the ETF space moving forward, particularly in the current environment of higher interest rates.

“I think we’ll see more flows into fixed income and as the flows come, I think we’ll see more products in that area,” Ms Gallagher says. “Year to date, we’ve had about 50 per cent of flows go into fixed income, and fixed income as an ETF category only accounts for 12 per cent of the AUM, so you can see how popular they are at the moment.”

While the Australian ETF industry has now grown to $139 billion in assets under management and accounts for almost 2 per cent of global flows, it still only represents approximately 1 per cent of the total assets that are in ETFs around the world.

“I think there’s definitely more room for the ETF industry to grow and our survey points to that,” Ms Gallagher predicts.

State Street’s survey determined that only 27 per cent of investors in Australia had an ETF in their portfolio compared to other types of investment vehicles. While globally, 42 per cent of the investors surveyed said that they owned an ETF in their portfolio, lower than stocks (77 per cent), mutual funds (56 per cent), and bonds (49 per cent).

“Given the benefits of ETFs — choice, diversification low cost, transparency, simplicity — I have full confidence that the market for ETFs will continue to grow significantly over the next two to five years,” says Ms Gallagher.

Important Risk Disclosures: SSGA, Australia Services Limited (AFSL Number 274900, ABN 16 108 671 441) is the AQUA Product Issuer for the CHESS Depositary Interests (or “CDIs”) created over Interests in SPY which were first quoted on the AQUA market of the ASX on 13 Oct 2014. State Street Global Advisors Trust Company (ARBN 619 273 817) is the trustee of, and the issuer of interests in, the SPDR® S&P 500® ETF Trust, an ETF registered with the United States Securities and Exchange Commission under the Investment Company Act of 1940 and principally listed and traded on NYSE Arca, Inc. under the symbol “SPY”. You should read and consider the PDS and TMD at ssga.com/au before making an investment decision.