1. High returns.

Over the past 10 years the main overseas indexes have significantly outperformed the ASX 200 in AUD (to 10/02/2023) and in some cases by a factor of more than 3-5X.

Nasdaq +639.76%

S&P 500 +383.20%

MSCI AC +226.81%

ASX 200 +128.15%

Source: Bloomberg Finance L.P. Past performance does not guarantee future results

2. Diversification beyond the domestic market reduces investment risk

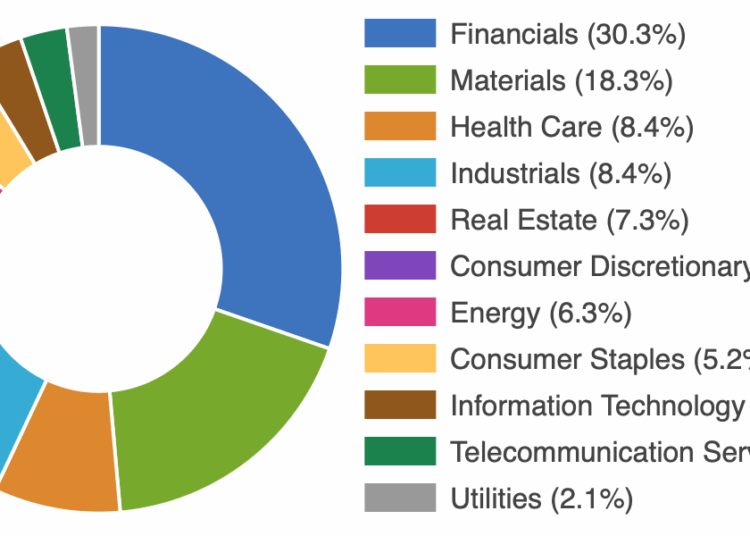

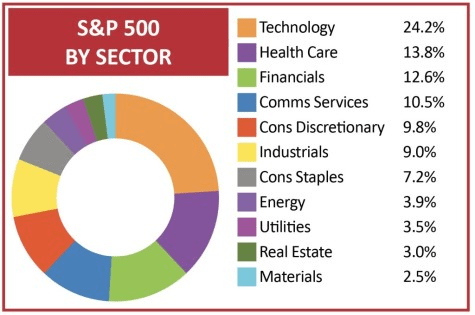

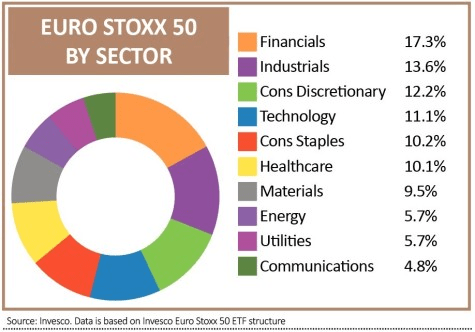

The Australian market is top heavy with banks and miners (almost 50%). Overseas markets are more evenly weighted and therefore more diversified.

Compare recent weightings in the ASX 200, the S&P 500 and the Euro Stoxx:

Source: Invesco Investment Solutions proprietary research reports.

Source: Invesco Investment Solutions proprietary research reports.

And remember Australia represents less than 2% of the World’s equity markets. ‘Domestic only” investors are missing out on the other 98%!!

3. Access industries and sectors not available in Australia as well as outsized investment returns in dominant global companies.

The world’s biggest and most successful technology, pharmaceutical, and biotechnology companies are all overseas. By investing ONLY in Australia, you have missed profiting in the “trillion-dollar club”-Apple, Microsoft, Amazon, and Alphabet.

How much of a gain have you missed?

10-year returns AUD (to 10/02/2023).

Microsoft +1318.53%

Apple +1218.46%

Amazon +1011.94%

Alphabet +616.66%

Source: Bloomberg Finance L.P. Past performance does not guarantee future results

And you also missed investing in the two companies that literally saved our lives- Covid vaccine makers Moderna +643.16% (12/06/18)and BioNTech +809.53% (10/11/19).

Not to mention the car company that launched the electric vehicle (EV) revolution- Tesla, which has generated a 11,648.345% 10-year return for prescient investors!

Source: Bloomberg Finance L.P. Past performance does not guarantee future results

4. Australia is not known for innovation. Mining yes. Innovation no.

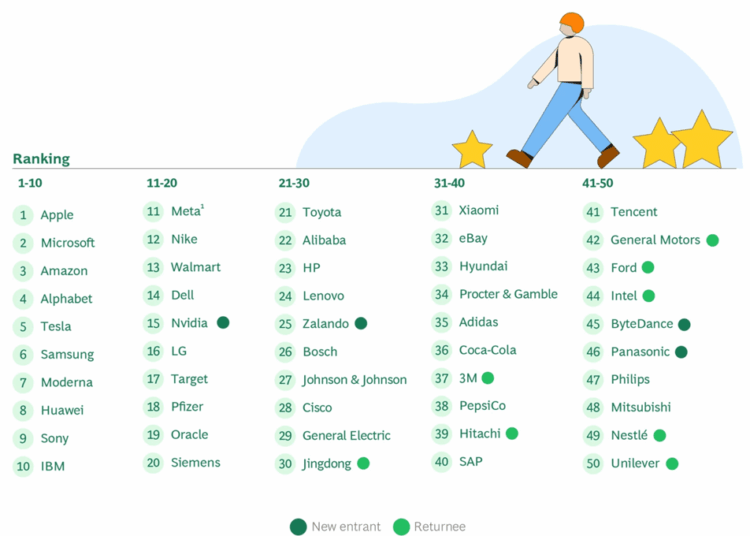

The most innovative companies usually produce the best long-term returns. And they are ALL overseas.

Here are the Boston Consulting Group’s most innovative companies in the world. Not an Australian company among them!

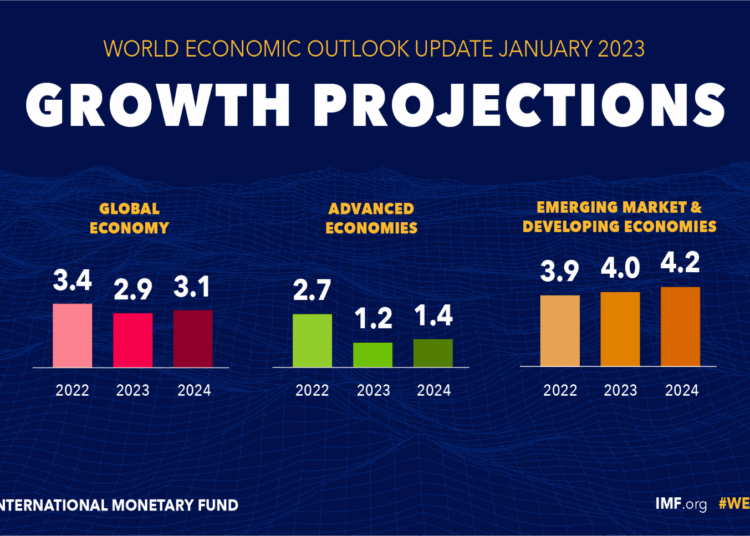

5. By investing outside Australia investors can access economies that have much higher growth.

Emerging Markets (India, China, Latin America) have much higher GDP growth and in many cases their markets are negatively correlated with the ASX 200.

Source: IMF.ORG

If you would like to find out how HALO Professional can help you and your clients, research and investment in global markets, contact the team on https://www.halo-technologies.com/adviser-request-a-call.