-

Get the latest news! Subscribe to the ifa bulletin

QSuper addresses retirees’ fear of money running out

One of the key concerns for people approaching and in retirement, is that they will outlive their savings.

- A

- A

- A

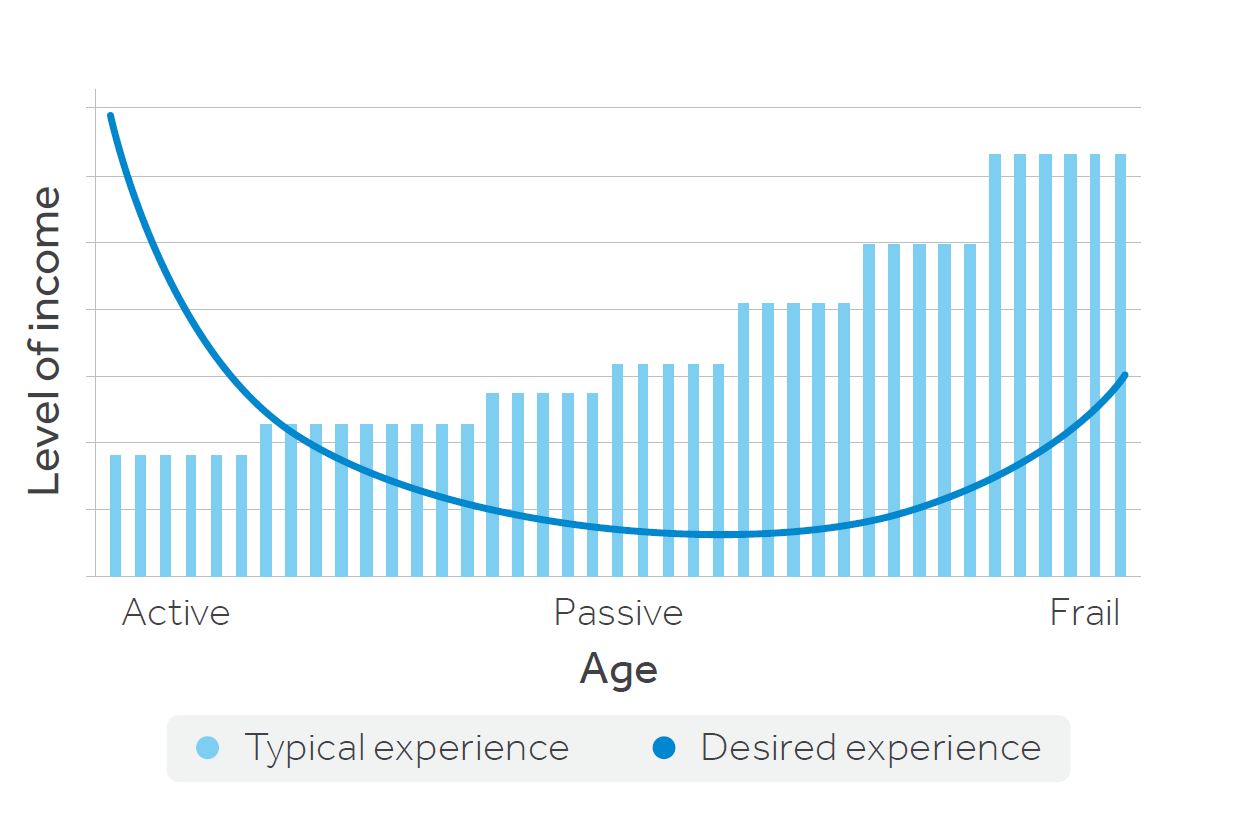

Research shows that while spending needs are generally higher in the early stages of retirement1, most retirees tend to spend less during this period and save for later in life for fear of running out of money.2

This means their superannuation account balance often increases over time and is potentially out of step with their desired spending needs, impacting their ability to enjoy their retirement to the full.

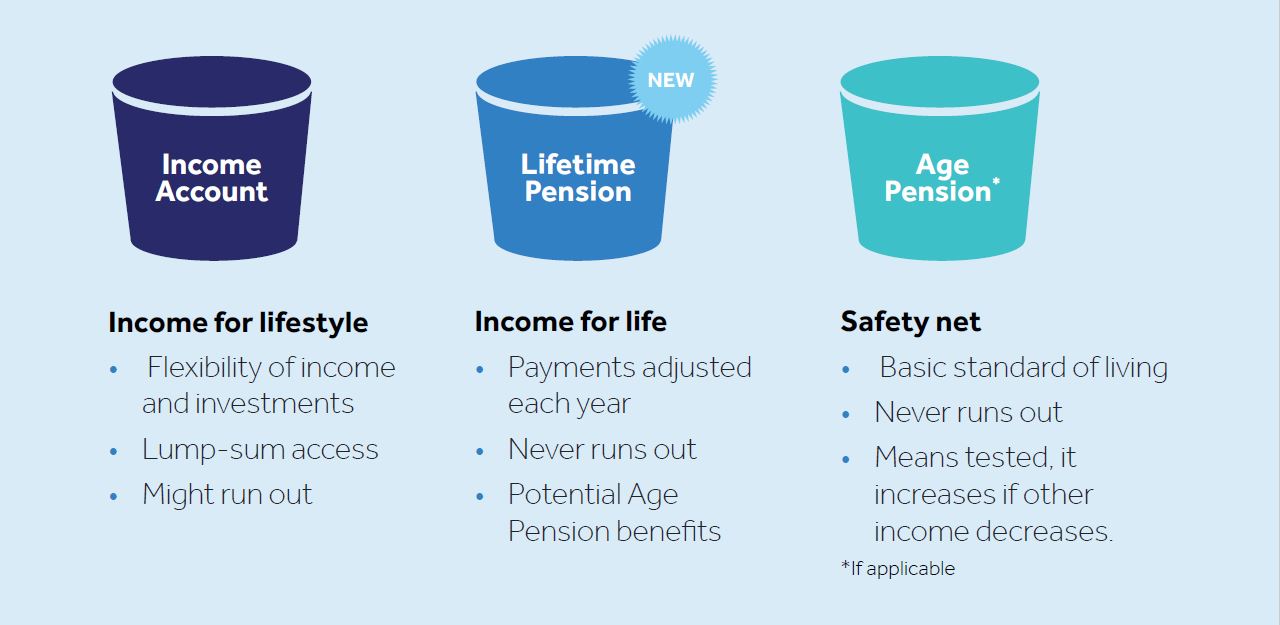

As one of Australia’s oldest and largest superannuation funds, QSuper knows the importance of making super last through retirement, which is why it has launched an industry-first product called Lifetime Pension. Available to eligible QSuper members aged between 60 and 80, the Lifetime Pension provides income for the rest of a member’s life through tax-free fortnightly payments. All Australians are invited to join QSuper, so the Lifetime Pension can be considered as part of any client’s strategy.

The Lifetime Pension is designed to work alongside a traditional income account and where possible the Age Pension, as an additional source of tax-free income, that helps to address longevity risk.

While similar to an annuity, Lifetime Pension is not an annuity. It offers income for a lifetime, but the income level will be adjusted year to year. This will allow QSuper to invest the Lifetime Pension pool of funds in a diversified portfolio with the objective to generate higher long-term returns and offer a higher level of income at commencement of the income stream.

Key product features

- Income for the rest of life

Once a person starts a Lifetime Pension, ongoing payments will be automatically made each fortnight into their bank account for the rest of their life. - Age Pension benefits

Only part of the Lifetime Pension (60%) is counted in asset and income tests, which may potentially increase a person’s Age Pension benefits, if eligible.3 - Spouse protection option

If a person chooses this option, payments will continue to be paid to their spouse for the rest of their spouse’s life if they pass away. - Money-back protection

If a Lifetime Pension purchaser passes away before receiving income payments equal to their original purchase price, the difference is payable as a death benefit to their beneficiaries or estate.4 - Cooling-off period

A six-month cooling-off period gives people time to decide whether the Lifetime Pension is right for them. After that, it is a permanent purchase.

A retirement income stream that never runs out

QSuper Chief of Member Experience Jason Murray said the development of Lifetime Pension had been driven by customer insights and aimed to provide greater confidence for retirees that their retirement savings would last their whole retirement.

“We have learnt many members leave behind significant balances – up to 90% of their starting retirement balances in some cases,” Mr Murray said.

“This is driven from concerns that they will need to preserve their wealth for the unexpected, or the obvious uncertainty regarding how long they will live.”

Mr Murray added that while a need was identified among QSuper members, “being an open fund means we can offer Lifetime Pension to new members, too”.

As the graph below indicates, spending needs tend to be higher in the earlier years of retirement and generally reduce over time.

Mr Murray said QSuper was well aware members put a great deal of trust in the fund to help them achieve the retirement that they deserve.

“When I reflect about our role in protecting members, a significant additional risk I think about is the risk that our members may run out of money during retirement or, as we quite often see, live quite frugally in retirement for fear that they will consume all of their retirement savings prematurely," he said.

"To address this risk, QSuper has worked hard in the background to develop a product to provide greater confidence to members and to deliver an income stream such that they can have comfort that their retirement savings will be there for their whole retirement."

How it works

Designed to work alongside a QSuper Retirement Income account, the Lifetime Pension provides regular payments for life, and may have added Age Pension benefits.

To find out more about QSuper’s Lifetime Pension

- Visit QSuper’s Lifetime Pension online hub for financial advisers for product features, eligibility requirements and other resources including Adviser guide, calculators, FAQs and the QSuper Product Disclosure Statement for Income Account and Lifetime Pension.

- Register for QSuper’s Income for Life online seminar with live Q&A on 19 May 2021 – secure your spot now.

[Footnotes]

1Actuaries Institute, 2019. “Spend your age, and a little more, for a happy retirement”. Actuaries Institute media releases.

2National Seniors Australia. 2020. “Retirement income worry: Who worries and why?”. January 2020.

3Under the means test rules, 60% of the purchase price is assessed until you reach the life expectancy for a 65-year-old male, which as at April 2021 is 84 years old. See the Australian Bureau of Statistics websitefor the latest life expectancy figures.

4Subject to the government’s Capital Access Schedule regulations. More details in the Product Disclosure Statement for Income Account and Lifetime Pension available on the QSuper website.

This information and QSuper products are issued by the QSuper Board (ABN 32 125 059 006, AFSL 489650) as trustee for QSuper (ABN 60 905 115 063). This is general information only, you should therefore consider the appropriateness of this information in light of your own objectives, financial situation, or needs before you make any decision. Consider whether the product is right for you by reading the product disclosure statement (PDS) available from our website or by calling us on 1300 360 750 to request a copy.

Subscribe to

Never miss the stories that impact the industry.