-

Get the latest news! Subscribe to the ifa bulletin

Superannuation trustees have received a letter from the prudential regulator, putting them on notice and explaining the methodology it will use to scrutinise performance.

The prudential regulator has written to registrable superannuation entities (RSEs) explaining how it plans to assess member outcomes.

The letter, written by APRA deputy chair Helen Rowell, notes that the regulator has "identified some RSE licensees that appear not to be consistently delivering quality member outcomes".

APRA proposed stricter rules governing the way super funds operate their businesses on 14 August, and Ms Rowell has previously urged underperforming trustees to "change or exit".

"It is necessary and timely for all RSE licensees to review, and consider whether there is a need to enhance their approach to delivering quality member outcomes and maintaining the future sustainability of their RSEs," Ms Rowell wrote in yesterday's letter.

The letter added that APRA will consider "whether insurance offerings may be inappropriately eroding member retirement benefits" – an issue that both sides of federal politics recently flagged as a concern.

Ms Rowell said APRA will assess the following metrics when considering historical member outcomes and future sustainability of super funds.

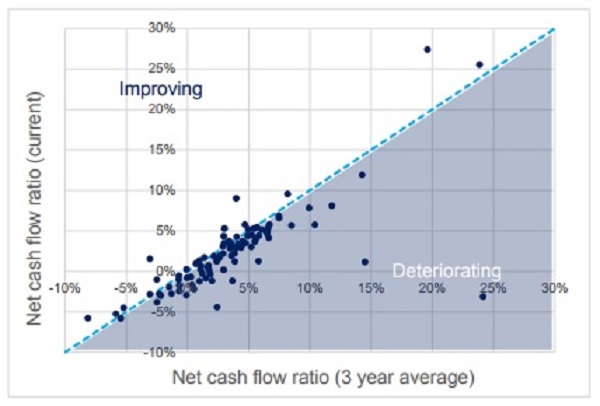

Ms Rowell also attached a chart (see below) showing that most super funds are in net outflow, adding that APRA will pay particular attention to RSEs where their net cash flow ratio is both "negative and deteriorating".

Never miss the stories that impact the industry.