In this article, we’ll look at why financial fraud is on the rise and discuss how businesses in the financial sector can protect themselves with thorough due diligence tools, including an examination of their existing and potential clients’ credit history and criminal risk.

Financial fraud is rising in 2022

Over the last decade or so, we have seen the proliferation of fintechs developing technologies aimed at fast-tracking, simplifying, and decentralising financial processes. These advances allow us to perform transactions that would have been unthinkable 20 years ago, like making instant transfers from one side of the world to the other or securing small personal loans outside of banking hours.

Thanks to these technological advances, companies are able to automate processes, like the approval of a loan or cash transfer, that would previously have required a laborious paper-based credit check. This has allowed them to cut down on admin costs, increase efficiency, and reduce reliance on major financial institutions to act as intermediaries, but it has also opened them up to heightened financial risk.

Studies have shown that fraud occurs in fintechs like neobanks at roughly double the rate of credit card companies. Rates of financial crime like fraud, blackmail, and extortion have been rising for a number of years; South Australia Police reported an increase in financial crime of 29 per cent between 2020 and 2021.

How to protect your business from fraud

There is no question that recent innovations have helped businesses boost efficiency and achieve growth. But protecting your finances doesn’t mean you need to forgo those benefits altogether; it just means that you need to be strategic about which transactions you automate and use only the best available systems.

It is important to conduct due diligence before taking on a new client. The best way to protect your business when you extend credit is to start with a credit check. Yet not all credit checks are equal. Gain an advantage with CreditorWatch’s credit check processes, which combine and analyse data from a wide range of sources to produce valuable insights and predictions on every business in Australia.

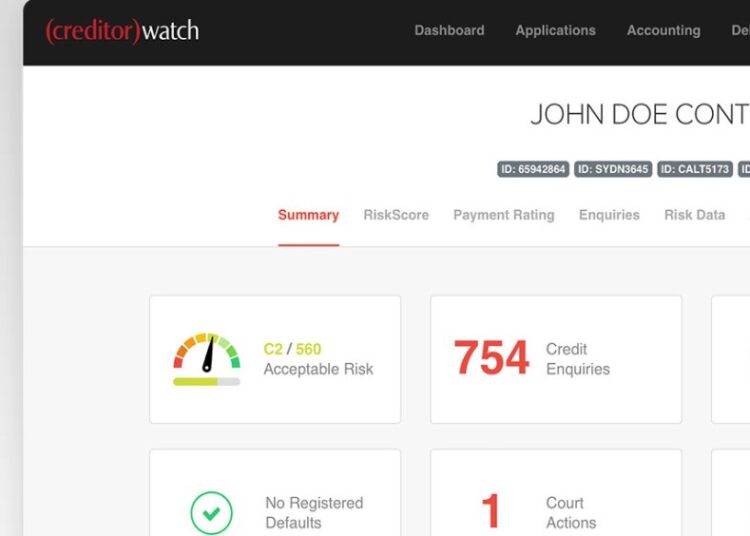

CreditorWatch has developed a unique suite of financial tools that use advanced AI automation to accurately calculate the credit risk posed by a potential debtor. RiskScore is the most predictive company credit score and rating system available in Australia. It uses more than 50 data points to generate a comprehensive credit report on any business, including credit and payment history and any high-risk indicators.

ApplyEasy is our onboarding tool that simplifies the credit application process into a single online form. Businesses can streamline and customise their credit approval process, automating credit checks and trade reference changes, to increase efficiency and security. ApplyEasy verifies entity information immediately, ensuring you know exactly who you’re bringing on as a new client.

CreditorWatch also offers ongoing credit monitoring and alerts for all the businesses in your portfolio. We will notify you in real-time of any adverse behaviour that could affect your debtor’s ability to meet their financial obligations. Meanwhile, our interactive trade payment program, DebtorLogic, analyses your Aged Trial Balance (ATB) to measure changes in payment behaviour over time and across markets, alerting you to adverse behaviour so you can take a proactive approach to debtor management.

Finally, our offering includes features designed specifically to help businesses identify and prevent financial crimes. Our Know Your Customer (KYC) and Anti-Money Laundering (AML) features give anyone the power to conduct advanced screening of their trading partners.

Our AML reports include politically exposed person (PEP) and sanction checks to identify involvement in bribery or corruption. They also include adverse media checks to reveal any negative news or coverage associated with the entity, and verification of identity (VOI) checks and document verification services (DVS) to avoid fraud. These procedures help to protect your business from illegal activity such as corruption, money laundering, tax evasion, theft and other financial crimes.

CreditorWatch works with some of Australia’s top financial businesses. To better understand how we can help you safeguard your business against fraud and financial crime, get in touch with us for a free demo today.