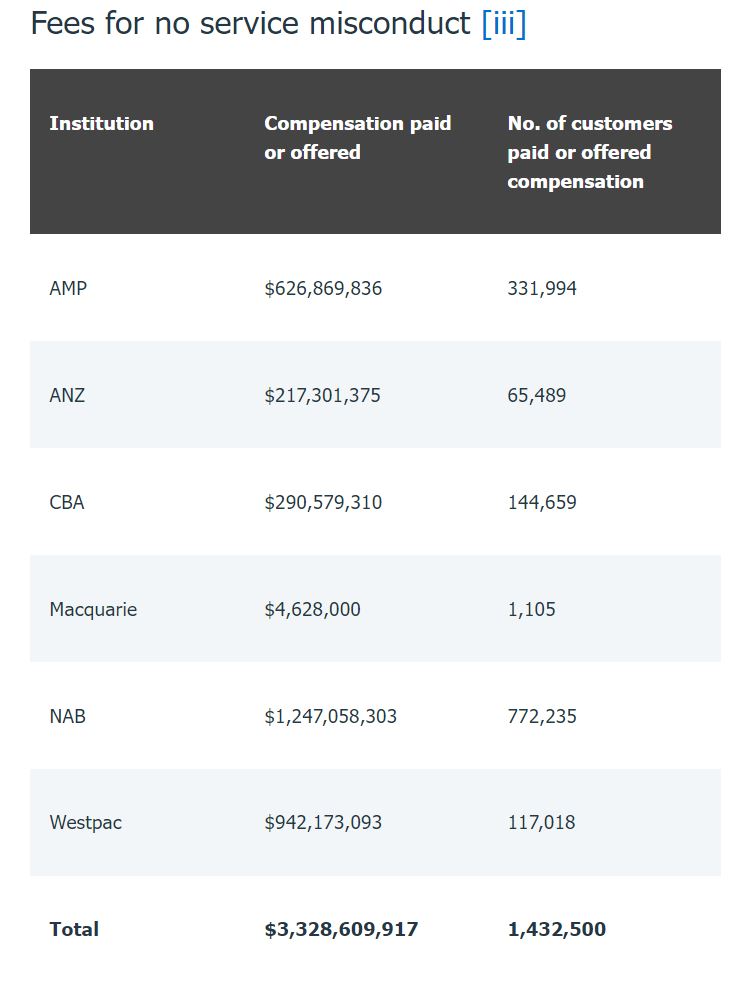

Six of Australia’s largest banking and financial institutions have paid or offered a total of $3.6 billion in compensation as at 30 June 2022 to customers who “suffered loss or detriment because of fees for no service misconduct or non-compliant advice”, ASIC has confirmed.

The corporate watchdog confirmed the news following a review undertaken by AMP, ANZ, CBA, Macquarie, NAB and Westpac, which also includes $438 million paid or offered between 1 January and 30 June 2022.

NAB paid or offered the most compensation for fees for no-service misconduct of the six institutions, with ASIC confirming the bank’s total to be $1,247,058,303, followed by Westpac at $942,173,093.

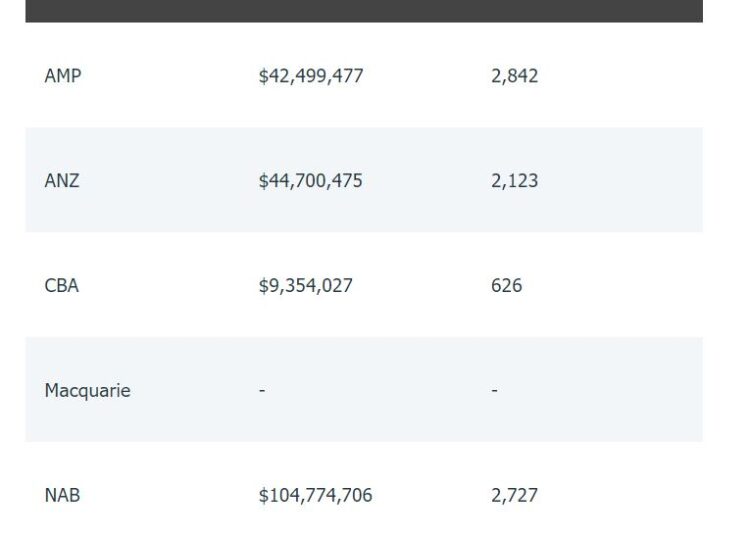

NAB also paid or offered the most compensation for non-compliant advice at $104,774,706.

ASIC commenced the reviews to look at “the extent of failure by the institutions to deliver ongoing advice services to financial advice customers who were paying fees to receive those services” and how effectively the institutions supervised their financial advisers to identify and deal with non-compliant advice.

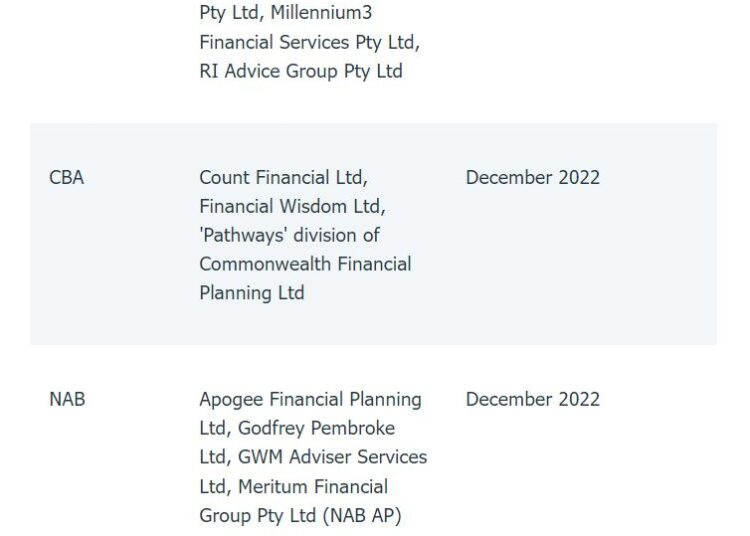

CBA, ANZ and Westpac have all notified ASIC that customers who have been identified as receiving inappropriate advice have been remediated.

In relation to the fees for no service, some of the institutions have not yet “substantially completed” programs, including Financial Services Partners (ANZ), expected to be completed next month, and Count Financial (CBA), set for completion in December.

The review and remediation program by the institutions came after two major reviews conducted by ASIC, first in 2016 when it described “systemic failures in the advice divisions of AMP, ANZ, CBA and NAB”.

In 2017, ASIC undertook another review into how large institutions oversee their advisers.

“Since the publication of this report, ASIC has been monitoring the ongoing implementation of the institutions’ customer review and remediation programs,” the regulator said.

Hey Michelle Levy, do you get it yet? If not just read some of the comments below.

Who wouldn’t be scared of a biased vindictive regulator that intimidates licensees into paying “remediation” in situations where there has been no breach of the law and no client detriment. And then gloats about it.

Who wouldn’t be scared of a rogue regulator that judges you to be guilty by default unless you have reams and reams of documentary evidence proving your innocence, in whatever arbitrary format they choose to request in the future.

and there lies the problem – advisers have been raising the issues from day 1 (always with respect and with the best intentions), but – no-one in a position of authority or influence ever listens, acts, or cares for that matter what advisers think. It is an Industry that is full of vested interests and conflicted stakeholders with way too much influence over the Govt., Treasury, ASIC, TPB and the AFCA, and continues to dismiss the adviser and the issues at ground zero.

I would say ASIC let’s no gloat or cheer….Some clients I drove to the Hospital and completed Centrelink applications but that’s not a service is it. Let’s remember the definition of a service is only production of a ROA so everything else Advisers do is not a service. I went through a look back program in 2018 relating to my time at Securitor from 2009-2011 some 9 years ago…I didnt’ have the files from year 9 so they paid them out. Many clients received payments because the rates charged by KPMG to review the file were more than the advice fee paid….some clients in 2009-2011 I actually had several meetings with, constant communication and file noted it but didn’t complete a “hold” ROA saying do nothing, because in 2009 you only did ROA’s when doing switches and doing an ROA to tell someone to do nothing was crazy talk. Unlike now in 2022 when someone rings me to tell me there a grandparent I do a hold ROA.

The issue is that Advisers DO NOT list all these services as part of “the service” they do not give clients their Terms & Conditions of trade, remember Advisers are subject to ACCC and ASIC guidelines

But is it? Where is ASIC’s guidance that the definition of a service is only production of an ROA? Is this documented in the Corps Act? Has ASIC released official guidance? Or are we assuming this only because of ASIC’s response to remediation? I have asked my Licensee this umpteen times and I get the same reply every time – there is no guidance – just complete an ROA every single year and for every single advice related transaction and don’t assume any other ‘service’ being classified as a service.

It’s not in the corps act but out of touch ASIC has stated within those fees for no service reports and clearly defined what they think a “Service” is. ASIC have very clearly written if you don’t want to rely on the provision of an ROA or a SOA as evidence of a service then go out and hire an independent external consultant to determine if a service is provided. [u]So No licensee is going to do that annually for every single file. [/u] I would claim any adviser that lists services such as a “phone call, sitting on the phone to Centrelink for 4 hours, or newsletter” blah blah blah, is clearly breaching ASIC definition of customer service and doing the entire industry as a disservice and pandering to ASIC. They think the only thing Advisers do is switch products and defined services accordingly.

Correct

Which is the No.1 major issue between financial adviser services (such as cash flow management, Centrelink management, estate planning and management etc.), and all of the other services advisers provide along with investment and portfolio management. If I am an accountant, I can charge hourly for business advisory (with little documentation) but if I’m a financial adviser and I am managing Centrelink (as well as investment management), I cannot charge anything extra as per ASIC’s definition of a service. I can complete an ROA for buys / sells and holds – which meets ASIC’s service definition, but the rest of the work is not considered “fee-able”, even though an accountant that does the same service is considered “fee-able”. Thank you to this forum for doing ASIC’s job.

‘Fees for [i]NO[/i][b][/b] service’? This catchphrase rolls off the tongue, but it is grossly misleading.

The vast majority of the $3.6B falls into one of the the following categories:

1. Fees for service, which the regulator later decided did not fit their narrow, extreme opinion about what services should be provided, and then applied this retrospectively without ever giving proper guidance

2. Fees for service, which weren’t documented in a manner ASIC decided is necessary, and then applied this retrospectively without ever giving proper guidance

3. Fees for service, which met ASIC’s retrospective criteria, but it was too hard to locate the file or easier/cheaper for the institution to pay out compensation rather then check the file.

We will never know the exact numbers I guess, but I would speculate the amount of money refunded to clients, who were genuinely dissatisfied with the service they received, was probably less than 0.1%

The ASIC bureaucrats can pat themselves on the back, and tell themselves they are modern day Robin Hood’s. But in reality they have destroyed careers and businesses, caused a mass exodus and now consumers cannot afford mainstream advice. Only the wealthy can afford financial advice. The rest are left to navigate the murky world of unregulated influencers, scammers and crypo sharks. The life insurance industry is also imploding, leaving consumers to rely on the pittance covered by super if they have any cover at all. Far more than $3.6B will be lost by consumers in the long-run…

All this by the big 5 and the biggest loser was Dover.

So someone remind me why the big defrauders get to keep their AFSL but a small-time adviser who stuffs up a FDS gets dragged over the coals.

The reason why complaints about advisers to AFCA are so low, they are already remediated. That’s like 12,000 AFCA complaints.

And who paid for ASIC to conduct these reviews? I’m sure the big offenders have not been fined nearly enough. I got fined though. Through ASIC levies for us advisers who have done no wrong. And I’ll keep reminding the Government and regulators of that until I get compensation for FFNS from ASIC.

ASIC please confirm how many AFSL RM’s, Bank Managers or Executive’s have been Fined, Banned and personally shamed ?

ASIC please confirm how many of these big Bank AFSL’s have been cancelled ?

“NONE, says ASIC” !!!

It’s fine for big banks to effectively steal over $6 Billion in Fees For No Service and not a single manager gets busted.

That’s the ASIC way, never bust the big wigs, just to lowly Advisers.

the consumers pay – and the banks still practice – all rotten to the core. the whole mess.

Ummm ….. where’s IOOF or did they have no FFNS clients?

Yes – and many of the clients have no idea why they received the money/compensation.

Correct. The devil is in the detail. I have clients who have received thousands of dollars back each for supposedly no service, yet all have been seen annually by me. I assume the ‘offender’ just decided to pay out rather than argue it. This is their choice of course, but it provides a very inaccurate picture.

That is correct, some of my previous bank clients are also my clients now. They were very happy with service now and were very happy with service when I was at bank, yet they received compensation.. I’m sure there is lots of clients who didn’t receive the service at bank though

Same for me – I just say “Think of it as a gift from the XYZ shareholders – take it move on”

Anonymous, being seen annually and providing a service are two different things.

Yes because ASIC defines “service” as selling BHP and buying RIO. Anything else is not a service.