Depreciation differences: old versus new residential properties

When discussing the potential benefits of owning an investment property with a client, it is important to inform them about depreciation.

Due to the significant deductions available, explaining the process and the rules surrounding making a depreciation claim can help to add value to your already existing service.

One of the questions staff at BMT Tax Depreciation receive most often from Property Managers, Real Estate Agents and their clients is in regards to the depreciation potential of older properties compared with newer properties. While the simple answer is that the owner of a newer property is likely to receive higher depreciation deductions, all investment properties (both new and old) will attract substantial depreciation deductions for their owners.

Newer properties generally contain more expensive plant and equipment assets due to their higher starting values. This will result in increased depreciation deductions for the owner. For the same reason, capital works deductions for the structural elements of a newer building are also generally higher. While 2.5% of the structural costs of a building can be claimed per year for forty years, construction costs generally increase over time, making capital works deductions for newer properties higher.

Owners of older properties are limited to claiming the residual value of the building up to forty years from construction. For instance, if an investment property is five years old, the remaining thirty five years of capital works deductions are claimable. Capital works deductions are governed by the date that construction began and claimable only for properties that commenced construction after the 15th of September 1987. Investors who own properties that are built before this date will still be able to claim depreciation for the plant and equipment assets contained within the property. Older properties also have often had renovations and updates completed over time. Even if a renovation was completed by a previous owner, so long as it occurred after the legislated dates, the owner will be entitled to claim capital works deductions for these items.

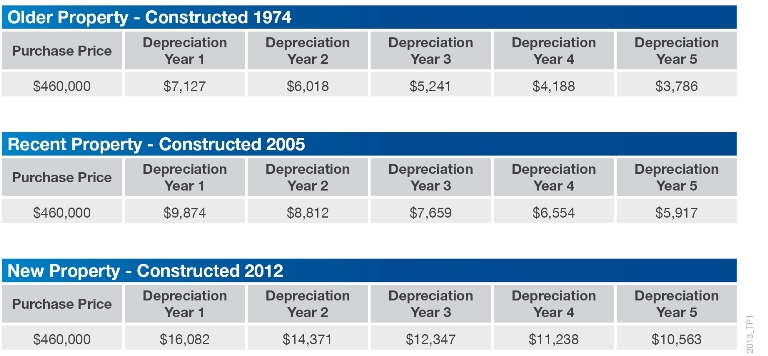

It is always worth recommending your clients to contact a specialist Quantity Surveyor to find out what depreciation deductions are available for their investment property. While deductions are not as high on an older property, there are still usually significant deductions available to warrant requesting a depreciation schedule in order to make a claim. The table below illustrates how depreciation deductions can vary between similar properties due to their construction dates.

As the table demonstrates, the owners of an older property constructed in 1974 can still claim $7,127 in the first year of ownership. Though it is not as high as a new property constructed in 2012, with $16,082 in depreciation deductions in the first year, these deductions can still make a huge difference to an investor’s cash flow.

On average BMT Tax Depreciation find between $5,000 and $10,000 in deductions in the first year for property investors. To find out what deductions are available for an investor client simply contact one of the friendly staff at BMT Tax Depreciation on 1300 728 726.

Subscribe to

Never miss the stories that impact the industry.