Ready to shift your business into a higher gear?

When the words ‘hybrid’ and ‘sustainability’ are used simultaneously, it’s most often in relation to future modes of transport. But there has been similar buzz around these two words in our industry in recent years.

When the words ‘hybrid’ and ‘sustainability’ are used simultaneously, it’s most often in relation to future modes of transport. But there has been similar buzz around these two words in our industry in recent years.

The structure of life insurance commissions and the sustainability of the industry is a hot topic. But the conversation is valid, and as professionals of this industry we should try to understand why the argument for hybrid and level over upfront isn’t going away.

The simple fact is, if you’re looking for a revenue structure that will provide a reliable income stream, sustainable growth and position you well for succession planning, a hybrid/level structure could be your best option.

We know one size doesn’t fit all, and there will always be reasons for upfront, but if you haven’t implemented some type of hybrid/level solution into your business, why not?

The commission debate

Let’s look at what the product manufacturers offer:

- Upfront – high initial payment and subsequent small annual ‘trail’ payments. Typical amounts are 110% in the first year and 10-15% thereafter.

- Hybrid – there are various hybrid forms, but all involve a lower ‘upfront’ payment in the initial year with higher than traditional trail payments thereafter. Percentages are somewhere in the vicinity of 85% in the first year, and 20% every year thereafter, or even 70/25%.

- Level – the same payment is made each year but in subsequent years these become much higher than trail payments made for upfront and, to a lesser extent, for hybrid. Typical amounts are around 32%.

As you can see, upfront commission wins in the short term. And many advisers still continue to favour the ‘upfront’ option. But how long are you planning on being in the risk business? If you’re thinking long-term, is this the best model for sustainable remuneration for you, your advice practice and, dare I say it, is it in the best interests of your clients?

What is sustainability, really?

I believe a sustainable remuneration model:

- contains payment features that generate revenue over the long term, and do not focus on short term gains without a bigger picture focus

- future-proofs an advice practice with a reliable income stream and ensures clients are provided with long term protection products that do not require new underwriting just because the business is replaced after a few years, and

- positions a practice well for succession planning, merger or acquisition by delivering a greater line of revenue which makes the business more appealing.

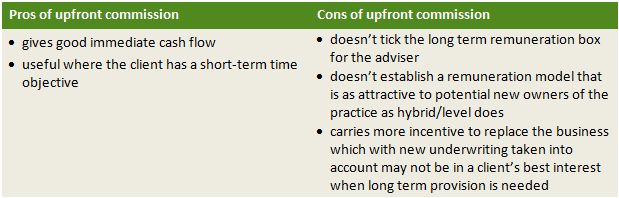

Comparing these outcomes against the different commission types, you could argue that upfront commissions are now in last place. But when conversation turns to the downside of upfront, rarely is there a clear understanding of the pros versus cons.

Again, as you can see, the cons for upfront clearly outweigh the pros.

So why is it that so many advisers favour the traditional up-front commission structure? The usual response is that advisers are focused on immediate cash flow and the upfront model certainly leads in that race.

High performance vehicles

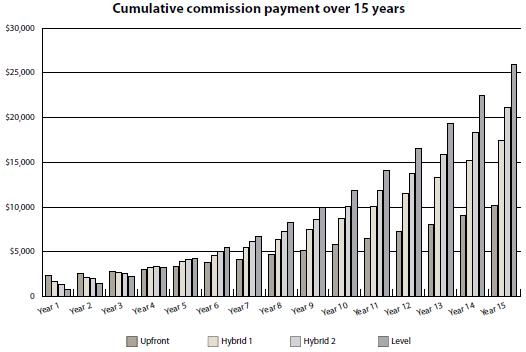

The chart below illustrates the cumulative commission payments paid from different commission styles for a single $2,000 policy. I’m often surprised at the misunderstanding around hybrid and level commissions because as the chart clearly indicates, there is long-term appeal in both; maximising recurring income streams and business value.

For a policy that remains in-force for 10 years, the revenue generated through level commission is double the upfront commission. That ratio climbs to 250% after 15 years.

With a client-centric business strategy, and the multiple of commissions rule to value a business, the implications are profound.

Where is the key?

The key is client-centricity. A discussion about commission structures goes hand in hand with a discussion about your client value proposition. Your client discussions should no longer revolve around product transactions, but long term advice with ongoing communication and review.

A client-centric business sees clients buying insurance, not because you sold it to them, but because it’s an important component of their financial strategy. If, through the comprehensive advice process, clients are educated about the importance of risk insurance and its role in their financial future, they are more likely to hang onto it long term – which under a hybrid structure, will see your client relationship, and your remuneration, only grow with time.

Supporting your value proposition

I strongly believe it is the role of a licensee to help advisers understand the benefits of different remuneration models, and the best value proposition for your business. Like in a good financial plan, it’s integral that you look at a complete and accurate picture for your business, not one that is specific to a manufacturer’s product type and structure.

While upfront certainly has its place for clients with short term objectives, hybrid and level structures offer far greater value over the 4 to 10 year time scale. These higher performance commission structures provide better cash flow management, greater commercial sustainability and revenue certainty.

Armed with a long-term and sustainable revenue stream which features a mix of hybrid and level commissions, your business will be more attractive to potential buyers when you’re ready to sell. And with the recent release of the BMW i8, it’s seems hybrid is about to become very, very cool.

Case study

Managing Director of Insurance Champions, Mark Davidson, is a risk-specialist advice practice based on the Sunshine Coast in Queensland. He’s been writing hybrid and level commission since his practice opened more than eight years ago.

Mark has seen the benefits of this remuneration model positively affect his practice, and his clients. This is because a hybrid and level commission structure aligns the interests of the life company, the adviser and the customer for effective and long term financial protection.

“I always hear the affordability argument, where some advisers claim to need upfront commissions when starting out, or to provide immediate revenue for business growth,” he said. But Mark believes that “having a high proportion of upfront not only puts a lot of pressure on the profitability of insurance companies, in my opinion it also encourages ‘churn’.”

“Level premium and hybrid commission hit a real sweet spot when properly combined, and it gives you an incentive to retain your clients. I’m now able to sit back a little and enjoy some of the fruits of all my hard work, because I ensured I built a revenue structure that is both long-term and sustainable.”

Mark added that by creating a long-term and sustainable revenue stream with a mix of hybrid and level commissions, his business would be more attractive to potential buyers should he one day be in a position to sell.

About Craig Parker

Craig Parker is general manager of the TAL-backed dealer group Affinia Financial Advisers. A seasoned finance professional, Craig has over 20 years’ experience in both retail and institutional banking. Having worked at firms including Macquarie, MLC and Virgin Money prior to joining TAL in 2010, Craig has honed his skills as a distribution and operations leader.

Subscribe to

Never miss the stories that impact the industry.