Market Sweet Spot – Global Mid-Small Cap Stocks

Promoted by

Most investors have no exposure to global mid-small caps, missing out on a plethora of under-researched, "hidden gems" that can be found outside of the mega-large cap universe. Entertainment One is one such example.

Entertainment One is a TV and film platform that benefits from new content distribution via Netflix, Hulu and Amazon Prime. Amazon & Netflix are expected to spend more than US$12.5b in the next 12 months on content alone. Entertainment One have innovated to meet this staggering demand for a wide range of audiences with exclusive rights to sell hugely successful shows like Designated Survivor outside the US through Netflix, and through building a family-oriented content portfolio led by Peppa Pig, the world’s leading pre-school brand, and more PJ Masks, a 50% joint venture with Disney.

Despite the power of the brands it distributes, small cap company Entertainment One is listed on the London Stock Exchange (FTSE 250 Index) with a market cap of only US$1.9 billion. Companies of such small size are outside the investable universe of most passive and active global equity managers, meaning mainstream investors miss out on many exciting, high growth opportunities.

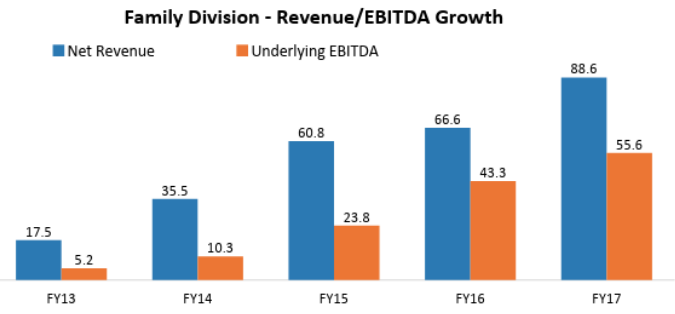

Below highlights the revenue growth that has been achieved over the last 5 years in the ‘crown jewel’ family division. According to Arik Star, Portfolio Manager of Ellerston Global Investments “We continue to see amazing upside with this business moving forward.” Arik Star emphasises that Entertainment One is only one of many examples that investors are missing out on by restricting themselves to just mega-large caps in their global portfolios.

Source: Entertainment One 2017 Full Year Results Presentation. EBITDA = Earnings before Interest, Taxes, Depreciation and Amortisation which is typically used as an indicator of the overall profitability of a business.

Ellerston Global Investments differs from the traditional approach to global equity investing by having a strong bias to global mid-small caps with a market cap bias up to US$10 billion.

Ellerston Capital is a Sydney based fund manager, currently managing $5.8bn. Portfolio Manager Arik Star has 23 years industry experience managing money for numerous family offices prior to joining Ellerston Capital in 2014.

To find out more, please contact [email protected] or visit our website www.ellerstoncapital.com

Subscribe to

Never miss the stories that impact the industry.