Infrastructure Doesn’t Need to be Actively Managed to Outperform

Promoted by ETF Securities

In this week’s ETFS Trade idea, we look at how CORE, which was launched in September 2017, is performing in comparison to a collection of well-known active and passive global infrastructure funds.

How does CORE compare to other infrastructure funds?

Many investors believe that infrastructure is a complicated asset class and requires active management to provide real long-term outperformance. As the analysis below will illustrate, this is simply not the case. Just

as with almost all asset classes, ETFs provide a strong alternative that investors should consider.

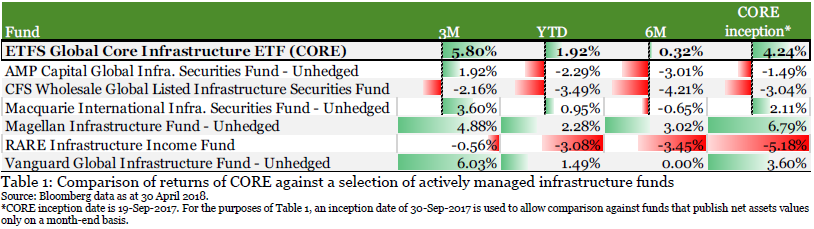

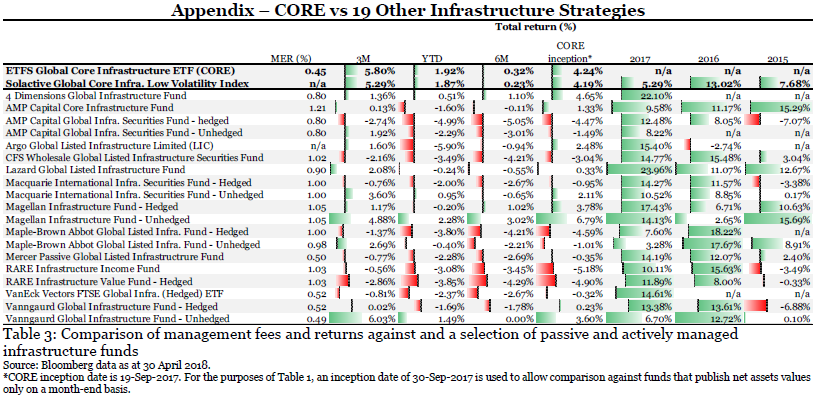

Table 1 compares the total returns of CORE (and its benchmark Index) against a selection of six other unhedged global infrastructure funds available to investors in Australia. Since its inception only one of those (Magellan Infrastructure Fund) has outperformed CORE.

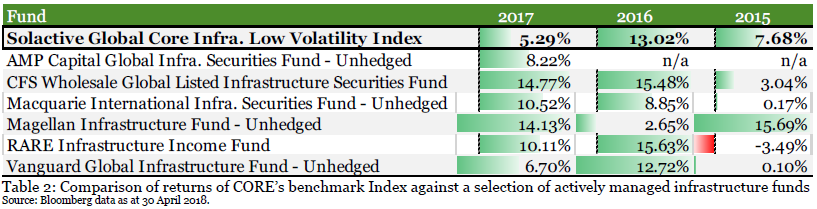

As CORE only launched in late-2017 we use the index to compare its longer-term performance in Table 2. During the bull market of 2017, as with low volatility strategies across the board, CORE would have underperformed, based on simulated index performance. However, it would have been amongst the top two performers in both 2015 and 2016.

What else is there to know about CORE?

CORE is the only infrastructure fund in Australia that runs a ‘smart-beta’ strategy to dynamically adjust its portfolio to reflect prevailing market conditions. It does so by tracking the Solactive Global Core Infrastructure Low Volatility Index (the ‘Index’). The strategy of the Index aims to outperform the wider infrastructure market by investing in stocks with the lowest realised volatility. These stocks are likely to be the ones with the most “desirable” qualities for infrastructure investors; i.e. stable returns with lower correlation to the wider equity markets.

Because CORE’s investment strategy is pre-defined it has several potential advantages over active funds:

- its strategy is consistent, published and available for investors to evaluate and scrutinise

- its holdings are published in the public domain daily

- because it trades on exchange, unlike many active funds it is available for investors to trade intraday

- because the fund does not require a team of fund managers to continually evaluate its holdings, it can charge management fees more in-line with passive index trackers

- CORE’s stocks allocations tend to be more “dynamic” than many other infrastructure funds due to the low volatility selection process it applies. This means that CORE will likely respond to changing market conditions differently to other funds

To demonstrate the impact of the low volatility filter, in its most recent rebalance in mid-March the Index reduced its exposure to the U.S. while increasing exposure to China, Japan, Taiwan and Canada. Sector-wise the Index underweighted the volatile energy sector as oil prices were hitting new multi-year highs and increased exposure to industrials as well as slightly increasing exposure to utilities. Whilst energy prices have continued to rise CORE is still one of the top performing funds over the past 3 months.

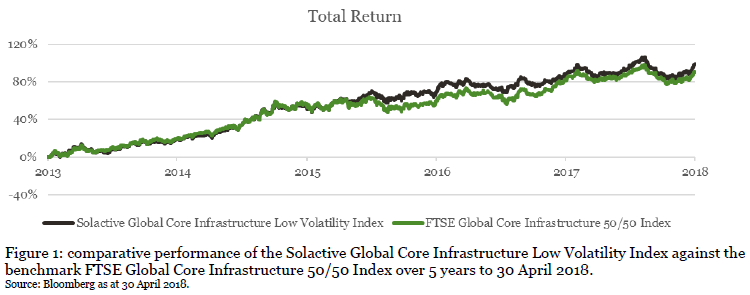

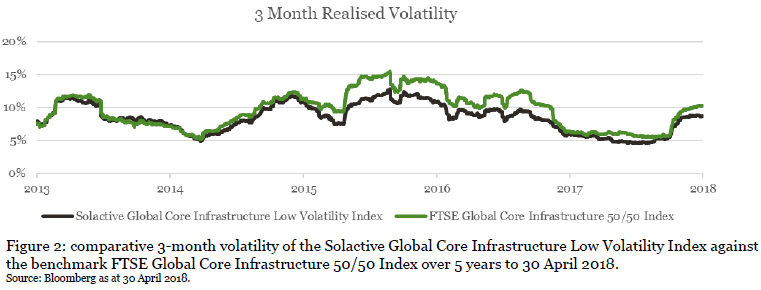

Figure 1, above, shows the comparative performance of the Index against the well-known FTSE Global Core Infrastructure 50/50 Index. Figure 2, shows the relative volatility levels of the two indices. Over five years the Index outperformed by close to 1% per annum. Volatility was on average over 1% per annum lower, despite the fact that the Index contains only 75 names compared to over 230 names for the FTSE index.

Furthermore, the Index was less correlated with global equity markets, as represented by the MSCI World Index over the same period.

Low Cost

Firstly, CORE’s management fee compares favourably to the active funds. CORE charges a fee of 0.45% p.a. (plus up to 0.10% p.a. of additional cost recoveries), which is below all the active funds detailed in the Appendix and significantly below the average MER of 0.87% p.a. of the funds profiled. Note that many of the active funds also charge performance fees, which are not shown here.

How CORE invests

ETFS Global Core Infrastructure ETF (CORE) follows a rules-based strategy, tracking its benchmark Index, and has the following features:

- CORE captures the performance of a selection of the 75 lowest volatility companies from the global infrastructure universe and aims to provide stable returns with regular income.

- CORE is the only ‘smart-beta’ fund focusing on infrastructure available in Australia.

- CORE is rebalanced semi-annually in March and September.

- CORE is weighted inversely in proportion to the volatility of each constituent, meaning that the stocks with the lowest volatility receive the highest weightings.

- CORE applies market capitalisation and liquidity limits and ensures sector diversity by capping individual sectors at a maximum of 50% (or 40 stocks) and individual industries at a maximum of 35%.

- CORE has an MER of 0.45% p.a. with up to a maximum of 0.10% p.a. of additional costs.

- CORE has an Investment Grade rating by Lonsec.

Summary

Actively managed exposures are not the only way to invest in Infrastructure and the above illustrates how using an ETF like CORE can provide outperformance vs many actively managed peers at significantly lower costs.

ETFS Global Core Infrastructure ETF factsheet

GET MORE INFORMATION

To sign up for future ETFS Trade ideas, email [email protected]

To find out more about ETF Securities products, visit www.etfsecurities.com.au

Subscribe to

Never miss the stories that impact the industry.