It is a commonly held belief that the changing guard of advisers lacks the life experience and mentorship that the more experienced advisers once provided. For newer advisers, there is the ever-present challenge of learning how to connect and engage effectively with clients. How to impart your values, and motivate your clients to take action, to take control over their financial wellbeing. If clients don’t feel emotionally connected to understanding and achieving their goals and objectives, they are less likely to value and commit to the advice process. And as we all know, if they do not value your advice, they are unlikely to be willing to pay for it!

Opinion is divided as to whether storytelling is an art or a science. I believe that storytelling is an art, and like all artistic endeavours, it takes time and practice. For some, storytelling comes naturally, and for some, it does not. Traditionally, life insurance advisers were great storytellers. They understood the importance of connecting with the client and sharing experiences that make the advice more tangible. Storytelling would help a client to understand and strongly believe in the importance of being protected and subsequently would proceed with their insurance recommendations.

In advice, effective storytelling can bolster the entire advice process, from engaging with prospects to the ongoing relationship with the client.

Why is storytelling so important for advisers?

Storytelling is a great way to connect with your clients and help them understand what often are, complicated concepts. It can help your clients to connect the dots between what the strategy looks like to achieve their goals and objectives, and why it is so important to them.

Great stories can motivate clients to take action, and they also are wonderful at helping you to put yourself in somebody else’s shoes and see things from a different perspective.

Telling a story can be as simple as reflecting on your experience, or that of someone close to you. The story should resonate with what the client in front of you is experiencing. Put them in someone else’s shoes so that they can better understand their personal situation, and connect the dots towards your advice.

Storytelling comes in many different forms

Employ it in written form (articles, blogs, social media, and even your advice documents!) Storytelling in spoken form is so powerful in introductory meetings as well as review meetings, keynotes, webinars, and videos, as well as via audio platforms such as podcasts.

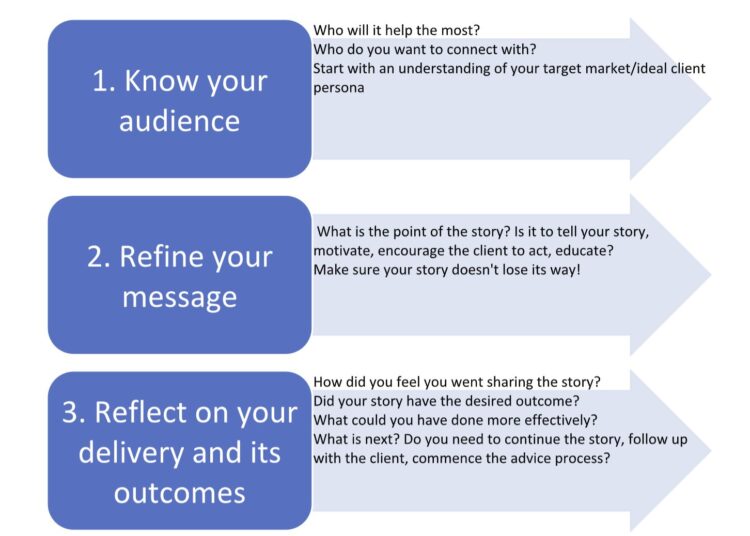

The storytelling process

5 tips for storytelling mastery

- Practice, practice, practice. Give it a try in a safe space — with your spouse, friend, colleague, or even a long-term client.

- Reflect. On your years of experience and the clients that you love working with. What are the problems that you need to solve for these people, and how can you best demonstrate that? How effective was your delivery, and did your story deliver the message that you intended?

- Structure. All good stories have a beginning, middle, and end! Ensuring you structure your story carefully to ensure less waffle and more substance!

- Observe. There are some amazing storytellers out there. Don’t restrict yourself to financial services.

- Be authentic. Effective storytelling connects you with your audience, and this can only be achieved by being true to who you are.

Finally, your language is critical. Steer clear of financial services jargon, keep it simple, and always remember that the story is never all about you. It is about how the client connects with the story you are telling and understands what steps next to take. Everybody has a story to tell. Tell yours!

Lisa Gregory, marketing development manager, Lifespan Financial Planning

I’ll think of that the next time I get a FDS signed on a Tuesday instead of the required Monday and therefore I’ve breached ASIC’s requirements. Of all the issues facing financial planning this isn’t in the top 50.

I couldn’t agree more. Clients are bombarded with jargon, in the form of all manner of TLAs (three letter acronyms): SoAs, FSGs, PDSs… they do not like them and do not understand them.

At the end of the day, we are offering clients an alternate future – there is no instant gratification. The clearer that they can see that future, the more readily they will embark on the journey towards it.

Well done Lisa, great article. Keep up the good work.